- Repsol has acquired Asterion Energies, which manages a portfolio of renewable belongings of seven,700 MW in Spain, Italy, and France for European infrastructure fund Asterion Industrial, for a complete of €560 million plus contingent funds of as much as €20 million.

- The transaction represents a brand new milestone within the achievement of Repsol’s 2021-2025 Strategic Plan, which foresees reaching 6,000 MW of put in renewable era capability by 2025 and 20,000 MW by 2030.

- Repsol thus strengthens its presence in key European markets and consolidates its worldwide growth in OECD markets. The corporate already has greater than 1,600 MW of renewable capability put in in Spain, america, Chile, and Portugal.

- Josu Jon Imaz, CEO of Repsol, mentioned: ‘We’re realizing our ambition to be leaders within the power transition by taking agency steps comparable to this asset acquisition to satisfy our objectives of progress, diversification, and concentrate on multi-energy. The initiatives and human expertise that we’re incorporating with this transaction completely complement our technique.’

- Jesus Olmos, Chief Government Officer of Asterion Industrial, mentioned: ‘We’re proud to have created this European platform from scratch and to have achieved exponential progress during the last three years. We’re satisfied that Repsol is the best accomplice to proceed this progress story and so contribute to the power transition.’

Repsol has introduced the acquisition of Asterion Energies from European infrastructure fund Asterion Industrial for €560 million plus as much as €20 million in contingent funds. The transaction is a vital milestone in Repsol’s ambition to develop into a worldwide participant in renewable power and strengthens the corporate’s place in key markets in Europe.

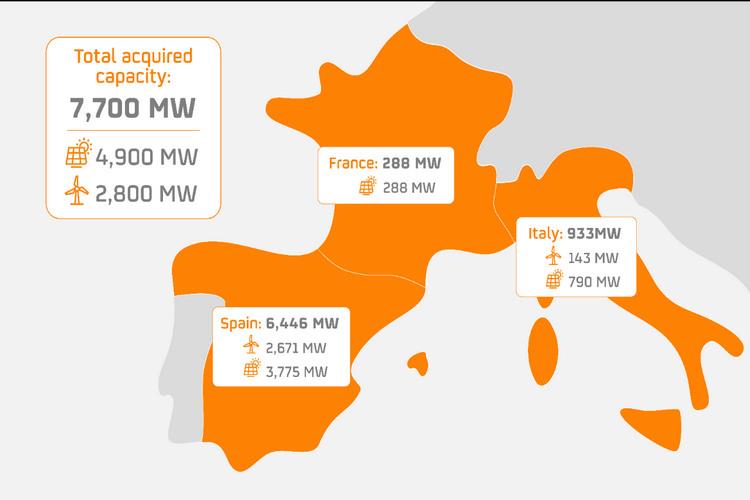

Asterion Energies manages a portfolio of renewable initiatives largely beneath growth totaling 7,700 megawatts (MW) in Spain (84%), Italy (12%), and France (4%), all of that are steady markets with excessive growth potential.

Asterion Energies’ asset portfolio consists of 4,900 MW of PV photo voltaic and a couple of,800 MW of wind era, of which 2,500 MW are at a complicated stage of growth or beneath development. As well as, Asterion Energies has an professional workforce with expertise within the growth of renewable and energy storage belongings that will probably be included into Repsol’s formidable progress undertaking on this enterprise.

For Josu Jon Imaz, CEO of Repsol: ‘We’re realizing our ambition to be leaders within the power transition, taking agency steps, comparable to this asset acquisition, to satisfy our objectives of progress, diversification, and concentrate on multi-energy. The initiatives and human expertise that we’re incorporating with this transaction completely complement our technique’.

Jesus Olmos, Chief Government Officer of Asterion Industrial: ‘We’re proud to have created this European platform from scratch and to have achieved exponential progress during the last three years. We’re satisfied that Repsol is the best accomplice to proceed this progress story and so contribute to the power transition.’

The operation is topic to plain approvals for this sort of transaction.

Rising worldwide presence in renewables

In 2019, Repsol grew to become the primary firm in its sector to decide to reaching zero internet emissions by 2050. Since then, the corporate has superior within the realization of its aims of geographically diversifying its renewables enterprise, complementing its capabilities, enhancing its portfolio, and making a strong platform with a excessive progress potential, with the ambition of changing into a worldwide renewables operator.

The corporate’s 2021-2025 Strategic Plan envisages reaching 6,000 MW of put in renewable era capability by 2025 and 20,000 MW by 2030. Repsol’s portfolio of renewable era initiatives, previous to this transaction, totals 1,600 MW. The corporate has 1,470 MW of put in renewables capability in Spain, 62.5 MW in america, 96 MW in Chile, and three MW from the WindFloat Atlantic floating windfarm in Portugal. As well as, it already has greater than 2,000 MW beneath development: 1,180 MW in Spain, 719 MW in america, and 120 MW in Chile.

Among the many firm’s most vital belongings in operation in Spain are the Delta wind farm within the northern area of Aragon (335 MW); the Valdesolar photo voltaic plant close to Badajoz in western Spain (264 MW); and the Kappa PV photo voltaic complicated positioned in Ciudad Actual in central Spain (126.6 MW). The Delta and Kappa initiatives are 49% owned by Pontegadea, one of many world’s main funding teams, and the Valdesolar undertaking is 49% owned by The Renewables Infrastructure Group (TRIG). The transactions involving the entry of a minority accomplice, carried out in November 2021 and March and July 2022, respectively, represented the consolidation of an asset rotation mannequin that reinforces its double-digit profitability. As for the Delta II wind undertaking, development work started in 2021 and two of its 26 wind farms are already in operation. This facility within the area of Aragon could have a complete capability of 860 MW, as soon as accomplished, making it the corporate’s largest renewable undertaking up to now.

As well as, in June 2022, Repsol included EIP and Crédit Agricole Assurances as companions in Repsol Renovables, a transaction that valued the enterprise unit at €4.383 billion.

Repsol additionally has different initiatives beneath growth in Spain totaling greater than 700 MW: the PI wind farm, positioned within the area of Castile and Leon; the Sigma photovoltaic undertaking, within the area of Andalusia; and two photovoltaic initiatives within the provinces of Alicante and Guadalajara which might be at present present process administrative allowing. The corporate additionally has a big hydroelectric portfolio in northern Spain (Aguayo-Aguilar, Navia, and Picos), with an put in capability of 693 MW in addition to an formidable undertaking to develop the Aguayo pumping station when regulatory circumstances permit.

Presence within the Americas

Repsol entered the U.S. renewables market, one of many largest and with the best progress potential on the earth, following the acquisition of 40% of Hecate Vitality. This firm specializes within the growth of photovoltaic photo voltaic and battery initiatives for power storage and has a portfolio of initiatives totaling greater than 40,000 MW. By means of this settlement, Repsol operates its first renewable undertaking within the nation, Jicarilla 2, positioned in New Mexico with 62.5 MW of whole put in capability. On the similar location, Repsol is growing one other photo voltaic plant, Jicarilla 1, with 62.5 MW of put in capability and 20 MW of battery storage. As well as, the corporate is constructing a 637 MW PV photo voltaic undertaking within the state of Texas, the corporate’s largest renewable set up within the nation up to now, which is able to come into operation in 2024. It has additionally taken FID for the 629 MW PV photo voltaic park Outpost.

In Chile, the alliance with Grupo Ibereólica Renovables provides Repsol entry to a portfolio of initiatives in operation, beneath development, and beneath growth of greater than 1,600 MW by 2025, with the potential for exceeding 2,600 MW in 2030. This three way partnership has accomplished the development of the Cabo Leones III wind farm, with 188 MW of capability, and it’s at present constructing the Atacama undertaking, with a complete put in capability of as much as 180 MW.

Supply: Repsol