Repsol (BME:REP) Will Pay A Bigger Dividend Than Final Yr At €0.2633

The board of Repsol, S.A. (BME:REP) has introduced that will probably be paying its dividend of €0.2633 on the eleventh of January, an elevated fee from final yr’s comparable dividend. This takes the annual fee to five.0% of the present inventory value, which is about common for the trade.

View our newest evaluation for Repsol

Repsol’s Dividend Is Effectively Lined By Earnings

We like a dividend to be constant over the long run, so checking whether or not it’s sustainable is necessary. Nonetheless, Repsol’s earnings simply cowl the dividend. Because of this most of its earnings are being retained to develop the enterprise.

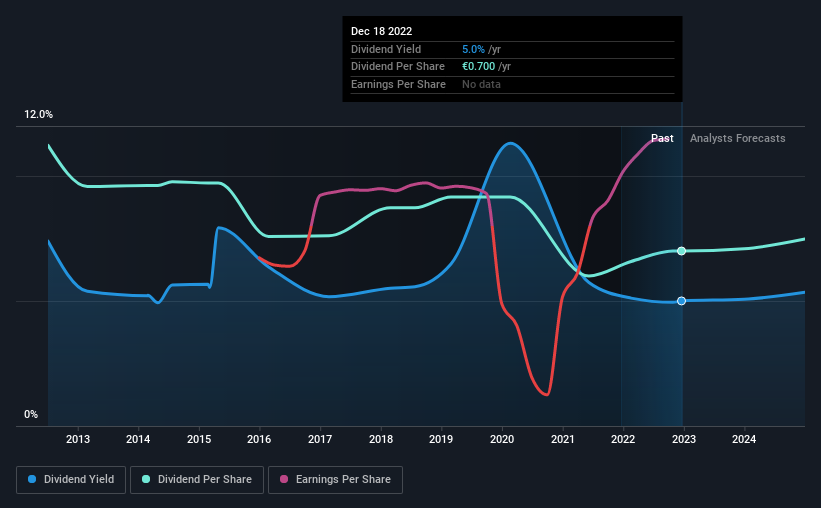

Wanting ahead, earnings per share is forecast to fall by 6.8% over the subsequent yr. Assuming the dividend continues alongside current developments, we imagine the payout ratio could possibly be 21%, which we’re fairly snug with and we predict is possible on an earnings foundation.

Dividend Volatility

Whereas the corporate has been paying a dividend for a very long time, it has minimize the dividend at the very least as soon as within the final 10 years. Since 2012, the dividend has gone from €1.12 complete yearly to €0.70. The dividend has shrunk at round 4.6% a yr throughout that interval. Typically, we do not prefer to see a dividend that has been declining over time as this will degrade shareholders’ returns and point out that the corporate could also be operating into issues.

The Dividend Appears Probably To Develop

With a comparatively unstable dividend, it is much more necessary to see if earnings per share is rising. Repsol has impressed us by rising EPS at 20% per yr over the previous 5 years. Earnings have been rising quickly, and with a low payout ratio we predict that the corporate may turn into a terrific dividend inventory.

We Actually Like Repsol’s Dividend

In abstract, it’s at all times optimistic to see the dividend being elevated, and we’re notably happy with its total sustainability. The corporate is producing loads of money, and the earnings additionally fairly simply cowl the distributions. We should always level out that the earnings are anticipated to fall over the subsequent 12 months, which will not be an issue if this does not develop into a development, however may trigger some turbulence within the subsequent yr. All of those components thought of, we predict this has strong potential as a dividend inventory.

It is necessary to notice that firms having a constant dividend coverage will generate better investor confidence than these having an erratic one. In the meantime, regardless of the significance of dividend funds, they don’t seem to be the one components our readers ought to know when assessing an organization. Working example: We have noticed 3 warning indicators for Repsol (of which 1 makes us a bit uncomfortable!) you need to learn about. On the lookout for extra high-yielding dividend concepts? Attempt our assortment of sturdy dividend payers.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not Repsol is probably over or undervalued by trying out our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to convey you long-term targeted evaluation pushed by elementary information. Word that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.